They indicate the degree to which a company’s operations are funded by its debt versus its equity. They also highlight the financial risk companies assume when they borrow to fund their operations. High ratios may be a red flag while low ratios generally indicate that a company is low-risk.

Quick Ratio: (Definition, Formula, Example, and More)

The Debt Ratio provides a broader view of a company’s financial leverage by comparing its total debt to its total assets. A higher Debt Ratio indicates that a larger portion of the company’s assets is financed through debt, which can be a sign of higher financial risk. For example, a Debt Ratio of 0.6 means that 60% of the company’s assets are financed by debt, leaving only 40% financed by equity. This ratio is valuable for understanding the overall risk profile of a company, as it highlights the extent to which the company relies on debt to fund its operations and growth.

How to Improve Gearing & Leverage Ratio?

Please note that the use of debt for financing a firm’s operations is not necessarily a bad thing. The extra income from a loan can help a business to expand its operations, enter new markets and improve business offerings, all of which could improve profitability in the long term. Another method to decrease your gearing ratio is to increase your sales in an attempt to increase revenue. You could also try to convince your lenders to convert your debt into shares. Raising capital by continuing to offer more shares would help decrease your gearing ratio.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- Gearing ratios play a significant role in shaping a company’s financial performance, influencing both its profitability and risk profile.

- They may decide to limit new debt acquisition, thus maintaining or lowering the ratio.

- A high gearing ratio suggests a company has significant debt, which could be a red flag for potential investors or lenders.

- R&G Plc’s balance sheet on 31 December 2017 shows total long-term debts of $500,000, total preferred share capital of $300,000, and total common share capital of $400,000.

Reduce Working Capital

However, when compared to its key competitor that reports leverage of 70% and the industry average of 75%, the company’s debt levels appear more satisfactory. Monopolistic companies often also have a higher what is business process improvement bpi because their financial risk is mitigated by their strong industry position. Additionally, capital-intensive industries, such as manufacturing, typically finance expensive equipment with debt, which leads to higher gearing ratios. A gearing ratio is a financial ratio that compares some owner equity (or capital) form to funds lent by the company. One can also calculate net gearing by dividing the total debt by the shareholders’ equity. By focusing on cost reduction and improving operational margins, companies can generate higher earnings before interest and taxes (EBIT), which positively impacts their interest coverage ratios.

How is fintech Impacting Businesses in Singapore?

Gearing ratios are financial ratios that compare some form of owner’s equity or capital to debt or funds borrowed by the company. Gearing is a measurement of the entity’s financial leverage which demonstrates the degree to which a firm’s activities are funded by shareholders’ funds versus creditors’ funds. A company with a highly geared capital structure will have to pay high fixed interest costs on long-term loans and more dividends on preferred stock.

Gearing: Definition, How It’s Measured, and Example

Thus, while both ratios are financial metrics, they highlight different aspects of a company’s financial status. A gearing ratio is a measure used by investors to establish a company’s financial leverage. In this context, leverage is the amount of funds acquired through creditor loans – or debt – compared to the funds acquired through equity capital. A higher gearing ratio indicates that a company has a higher degree of financial leverage. It’s more susceptible to downturns in the economy and the business cycle because companies that have higher leverage have higher amounts of debt compared to shareholders’ equity.

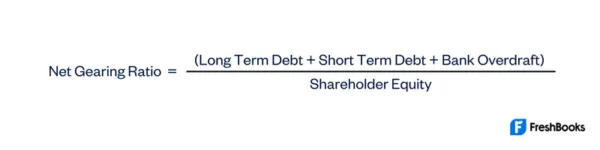

The net gearing ratio is the most commonly used gearing ratio in financial markets. The D/E ratio measures how much a company is funded by debt versus how much is financed by equity. Put simply, it compares a company’s total debt obligations to its shareholder equity.

Streamlining operations and cutting unnecessary expenses can free up resources to service debt and invest in growth opportunities, thereby reducing financial risk. The gearing ratio is also referred to as the leverage ratio in the UK, measuring the extent to which a company’s operations are funded by debt rather than equity. A higher gearing ratio means the company is more reliant on debt financing, while a lower ratio means it is financed mostly through equity. Gearing ratios are financial metrics that compare a company’s debt to some form of its capital or equity.